The latest economic outlook from the OECD highlights the precarious path for Australia over the next few years.

As Labour market and Fiscal Policy Director, Greg Jericho, notes in in his Guardian Australia column, the OECD predicts in both 2023 and 2024 Australia’s economy will grow by less than 2%. In the past such weak growth has been associated with recessions. And while a recession is not predicted, unlike for the UK and Germany, the OECD also notes the risks that lie ahead.

One major problem is that most nations around the world are lifting interest rates to attempt to slow their economies and thus reduce inflation. The OECD notes however that when nations act in concert the impact of higher interest rates on slowing the economy is greater, while the impact on slowing inflation is weaker.

Given Australia has a higher proportion of mortgage holders with variable rates this increases the risk that higher interest rates will slow our economy more than in other nations, and still have less impact on inflation.

But one sector of the economy are rejoicing at the current conditions that are causing the rising inflation – energy companies.

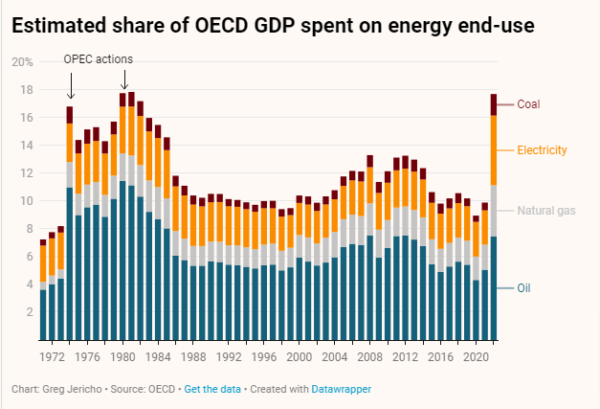

The OECD notes that the share of GDP being spent on energy by OECD nations is higher now than it was during the OPEC crisis in 1974 and 1980. The evidence again is clear that a windfall profits tax should be levied on coal, oil and gas companies who a reaping massive profits while the cost of living rises sharply for households.

You might also like

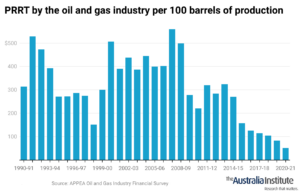

The gas industry is laughing at us as they make more money but not more tax

Despite soaring production and revenues the gas industry is not paying more tax

Australia is an energy super power, we need to use that power for good

Australia is already an energy superpower, but our governments have lacked the courage to use that power to reduce greenhouse gas emissions

Australia’s “stupid” surplus obsession must end

A budget surplus doesn’t mean a government is good at running the economy – we should focus on the choices they make instead, says Greg Jericho.